Understanding the Consolidated Omnibus Budget Reconciliation Act (COBRA)

October 10, 2023 by Rebecca Ahn

Request Pricing

Compare our rates to other providers

When a reduction event takes place, HR understandably has its hands full with numerous tasks. From helping with employee selection to conducting layoff meetings, it’s easy to see how a reduction in force (RIF) or layoff can be overwhelming. But there’s one thing that HR cannot afford to forget: the Consolidated Omnibus Budget Reconciliation Act (COBRA).

In order to fully comply with COBRA regulations, employers need to follow a strict COBRA notice timeline which dictates when and how to send COBRA notices to your employees.

In this article, we’ll go over everything you need to know to comply with COBRA rules for employers, including:

- What COBRA is and why it is important

- What are and are not qualifying events for COBRA

- The maximum COBRA coverage for qualifying events

- What the COBRA notice timeline looks like

- Penalties for non-compliance with COBRA regulations

What is the Consolidated Omnibus Budget Reconciliation Act (COBRA)?

The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 is a federal law that requires organizations to allow workers to continue their existing healthcare coverage after an event that would usually cancel it. COBRA applies to organizations that offer healthcare plans and have 20 or more employees.

In other words, when an employee who has a healthcare plan through an organization is terminated (or goes through a similar ‘qualifying event’), COBRA allows them to keep their healthcare plan if they cover the cost of their premium. This allows continuous healthcare coverage for individuals and their dependents even in the event of job loss.

Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), employers will need to provide COBRA benefits to any qualified beneficiaries who are covered under their healthcare plan on the day before a qualifying event occurs (we’ll go over what these events are in a minute). These qualified beneficiaries include:

- Employees (including part-time employees participating in your plan on the day before the qualifying event)

- Spouses of your employees

- Dependents of your employees

- Retirees (unless they are eligible for Medicare)

- Partners in a partnership

Understanding COBRA: Qualifying Events

Now that we have covered what COBRA is in general terms, we can dive deeper into the qualifying events that trigger it. Understanding qualifying events is the first step in understanding how to follow the proper COBRA notification timeline. After all, if you don’t know when COBRA rules for employers kick in, how are you supposed to know when to send the notice?

In short, a qualifying event occurs when an employee goes through a transition that would normally terminate the healthcare plan they receive from their employer.

The Following Are Considered a Qualifying Event Under COBRA

- An employee’s reduction in hours of employment

- An employee’s voluntary or involuntary termination of employment (unless they are being terminated for gross misconduct)

- A covered spouse’s legal separation or divorce from an employee

- An employee’s change in status as a covered dependent

- An employee’s entitlement to Medicare

- An employee’s death

- An employee’s return to active military duty

- An employee’s failure to return to work following family/medical leave during which healthcare coverage was lost

- Your company’s bankruptcy

For our use in this blog, we will be primarily looking at the first two events on this list: reduction in work hours (such as from full-time to part-time) and voluntary or involuntary terminations (such as RIFs or layoffs).

However, just because we don’t cover them here doesn’t mean that you can ignore COBRA regulations for the other qualifying events on this list. Always make sure to do your due diligence in following the COBRA laws and regulations set forth by the DOL.

What Is Not a COBRA Qualifying Event?

It’s equally important to understand what is NOT a qualifying event under the Consolidated Omnibus Budget Reconciliation Act (COBRA). As we mentioned in the list above, an employee’s termination usually counts as a qualifying event. However, this is not the case if the termination is a result of gross misconduct on the part of the employee.

Although the Consolidated Omnibus Budget Reconciliation Act (COBRA) doesn’t offer a definition of gross misconduct, the following criteria are helpful to consider when determining whether or not to withhold COBRA on the grounds of gross misconduct:

- If there is a connection between the offense and the employee’s job.

- If the offense was willful.

- If the employee understands the gravity of the misconduct.

- If the employee decides to challenge your determination, which may lead to a costly enforcement lawsuit that could end up costing your organization more than providing the COBRA coverage would have.

You also do not need to offer continued COBRA coverage to any employees who have not yet become eligible for your organization’s group healthcare plan, those who have declined to participate in your group healthcare plan, or those already enrolled in benefits under Medicare.

What Else Is Needed to Qualify for COBRA?

There is one more thing to consider when determining if the COBRA rules for employers apply to your situation.

In order for individuals to be covered under COBRA, an organization’s healthcare plan must first be covered by the Consolidated Omnibus Budget Reconciliation Act (COBRA). So check with your healthcare provider to confirm if this is the case.

Then for an impacted employee to qualify, they also need to have been covered by the aforementioned healthcare plan for at least one day before a qualifying event like those listed above occurs.

How Long Can You Stay on COBRA?

Now that we understand what is and isn’t a qualifying event under the Consolidated Omnibus Budget Reconciliation Act (COBRA), let’s talk about how long COBRA is available to someone who experiences one of these qualifying events like loss of employment.

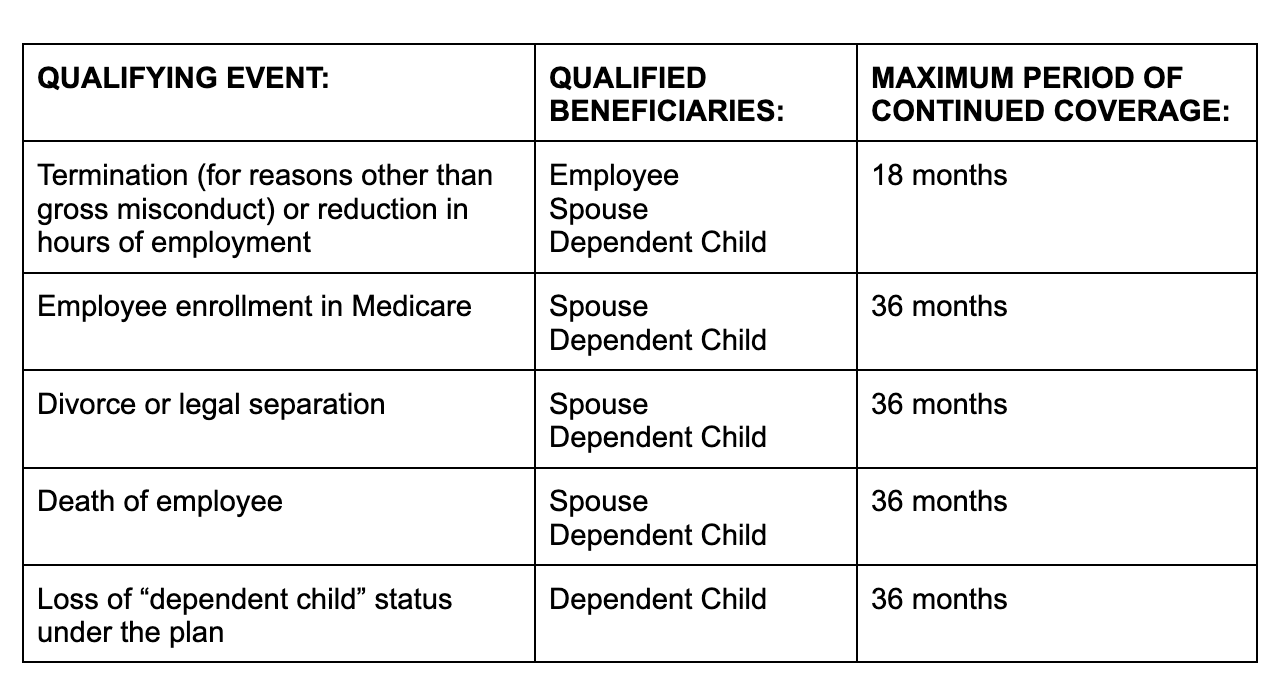

The length of time employees can continue their COBRA coverage after the qualifying event takes place is largely dependent on what type of qualifying event you’re dealing with. For example, if the qualifying event is termination of employment (other than for gross misconduct) or a reduction in work hours, the maximum continuation coverage period is 18 months in most cases. There are a few exceptions that allow extensions in special circumstances, such as if a qualified beneficiary is disabled or if a second qualifying event occurs.

Below is a table outlining the qualifying events and their corresponding maximum length of coverage set by the US Department of Labor:

Now the healthcare plan administrator may terminate COBRA continuation coverage earlier than the end of the above maximum coverage period for any of the following reasons:

- Premiums are not paid in full on a timely basis.

- The employer ceases to maintain any group healthcare plan.

- A qualified beneficiary begins coverage under another group healthcare plan after electing continuation coverage.

- A qualified beneficiary becomes entitled to Medicare benefits after electing continuation coverage.

- A qualified beneficiary engages in fraud or other conduct that would justify terminating coverage of a similarly situated participant or beneficiary not receiving continuation coverage.

If continuation coverage is terminated early, the plan administrator must provide the qualified beneficiary with an early termination notice. We’ll go into more depth on the COBRA notification timeline and required notices in the next section.

Of course, always remember to coordinate with your legal team to ensure you are following all applicable local, state, and federal laws when dealing with a reduction event. The Consolidated Omnibus Budget Reconciliation Act (COBRA) is just one part of a much larger legal puzzle.

To fully understand COBRA, head over to the US Department of Labor’s site here.

COBRA Notice Timeline: How and When to Notify

Let’s go over the Consolidated Omnibus Budget Reconciliation Act (COBRA) notification timeline you must follow in order to be in compliance. To ensure you are following the required COBRA timeline, it’s once again helpful to consider the qualifying event that is taking place.

For a layoff or reduction in force (RIF), which is typically a planned out process that HR is heavily involved in, this type of qualifying event shouldn’t be an unexpected surprise. So you should also have enough time to properly plan a COBRA notice timeline to ensure you are complying with all regulations. However, a more unforeseen qualifying event may make it harder to stay on top of all COBRA regulations in a timely manner. So it’s good to familiarize yourself with the full COBRA timeline and ensure you are as prepared as possible.

When any qualifying event we covered above occurs, you will have 30 days to notify the plan administrator (e.g. your healthcare insurance provider) of the qualifying event.

The only exception to this is in the event of a divorce, legal separation, or change of status by a dependent. In those qualifying events, the covered employee or one of the qualified beneficiaries is responsible for notifying the plan administrator, usually within a period of 60 days.

Following either such notice, the healthcare plan administrator then has 14 days to send a COBRA election notice to all impacted employees who are entitled to COBRA coverage.

Once that COBRA election notice is sent, the qualified employee has 60 days from the time of the notice to respond and notify you that they do want continued coverage. This response can come in the form of a letter, phone call, in person notification, etc.

Besides notifying the plan provider, who will reach out with coverage details to those impacted, you must also alert impacted employees of their election rights under the Consolidated Omnibus Budget Reconciliation Act (COBRA) when the qualifying event takes place.

To learn the details of these notification letters, see the DOL regulations here.

COBRA Notice Timeline: What Makes You Ineligible?

As we explained above, once you have notified the qualified employee of their eligibility for the Consolidated Omnibus Budget Reconciliation Act (COBRA), the employee has 60 days to confirm that they do elect COBRA continuation coverage. If they fail to notify you of that election within the 60-day window, they will become ineligible for COBRA.

An employee or qualified beneficiary who elects to receive COBRA may also become ineligible if they fail to make an initial premium payment within a 45-day period. Their COBRA plan should establish due dates for any premiums for subsequent periods of coverage, with a minimum 30-day grace period for each payment. Failure to meet these due dates will also result in the termination of the qualified beneficiary’s COBRA rights.

What Makes You Non-Compliant with COBRA?

As for you and your organization, you may also find yourself in non-compliance with COBRA if you fail to provide any of the required notices in the designated COBRA timeline. This includes failure to notify your plan administrator within 30 days (or 60 days in the event of a divorce or change of status by a dependent), failure to alert your impacted employees of their election rights, or failure to provide timely notice in the event of early termination of COBRA coverage.

If you fail to comply with these Consolidated Omnibus Budget Reconciliation Act (COBRA) rules for employers, the IRS can charge you $100 tax per day of non-compliance per person or $200 tax per day per family. If the IRS decides to audit you and you have not corrected the violation, you could face a $2,500 fine per beneficiary, though the lesser of these two penalties is generally what you would be fined.

That said, if the IRS determines the violation to be “more than trivial,” your organization could face up to a $15,000 fine. Then there’s always the fact that employees and qualified beneficiaries have the right to sue to cover any medical expenses incurred when the continued COBRA coverage should have been offered, which means you could end up on the hook for considerable legal fees, including attorney fees for the employee’s party if they win the case.

So it’s important to consider all of these potential costs and work with your legal team to ensure you are in full compliance with all Consolidated Omnibus Budget Reconciliation Act (COBRA) regulations.

COBRA Notice Timeline: A Brief Recap

Let’s review what we’ve covered in terms of the Consolidated Omnibus Budget Reconciliation Act (COBRA) notification timeline:

- First, a qualifying event occurs.

- You must notify all qualified impacted employees about their COBRA and election rights.

- You have 30 days to alert your healthcare plan administrator.

- The plan administrator then has 14 days to reach out to the impacted employees with election notices.

- Employees have 60 days to accept or decline COBRA. This 60-day window starts either when the event takes place or when the notice is given, whichever date is later.

- Employees can notify you that they wish to elect COBRA coverage via email, phone, in person confirmation, or any other form of communication.

- If employees do not notify you within 60 days, they are no longer eligible for COBRA.

- Depending on the qualifying event, coverage can last different maximum lengths of time.

This is a brief overview of the Consolidated Omnibus Budget Reconciliation Act (COBRA) notice timeline and the role of HR in the whole process.

Remember, we are not lawyers. Always consult your legal team when conducting a qualifying event such as a RIF or layoff to ensure you are complying with all local, state, and federal laws. We cannot say this enough.

Understanding COBRA: Final Takeaways

The Consolidated Omnibus Budget Reconciliation Act (COBRA) can be very confusing, especially for those going through the process for the first time. Understanding the COBRA timeline and rules for employers will help you better prepare for the future.

To learn more about COBRA, always go straight to the source. The US Department of Labor has exhaustively covered all COBRA regulations on their site here.

You will also want to consider other important elements for conducting a productive and positive reduction event, such as offering additional outplacement support to your impacted employees. This can save your organization considerable costs by helping your impacted employees more quickly find new employment, thereby reducing the amount of severance and unemployment benefits (including COBRA, if you opt to cover any or all of its cost) that you would need to provide to those employees.

More from Careerminds

In need of outplacement assistance?

At Careerminds, we care about people first. That’s why we offer personalized talent management solutions for every level at lower costs, globally.